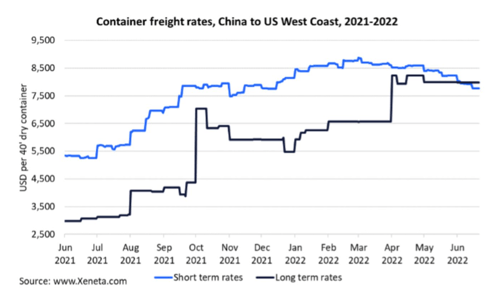

Ocean spot rates have been dropping since May - but long-term ocean contracts are staying high. We’re all watching the market closely, biding our time until the perfect moment to tender for long-term contracts.

So, what exactly is happening in the ocean freight market right now? And when will the stagnant ocean contract market finally start to drop?

What are ocean freight rates doing right now?

Over the last few months, ocean spot rates have been declining. All the while, contract rates have remained stagnant. This has led to an almost unprecedented market situation: spot prices are lower than contract rates.

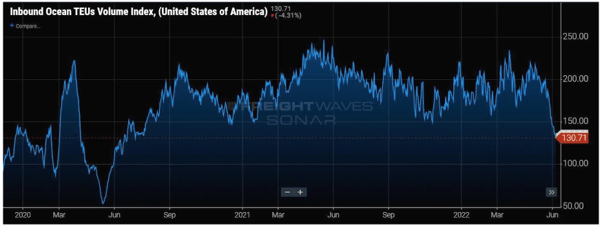

This unusual situation is caused by a decrease in consumer demand (container imports bound for the U.S. have dropped over 36% since May 24th) and increasing capacity pushing spot rates down. While shippers’ uncertainty in the market and fear of disruptions are keeping contract rates artificially high.

But this situation can’t last forever. When spot rates drop – contract rates always follow. So, when will ocean contract rates catch up to spot?

When will ocean contract rates start to go down?

The combined global contract market is currently stable, but this indicates a downward trend is already happening on some key lanes. Now’s the time to start tracking your heaviest lanes to see where you can start making savings.

If you can’t save right now, you may not have to wait much longer. We’re going to start seeing a steady decrease in rates over time. This drop will be global – as the entire world is experiencing an increased cost of living due to oil prices and the war in Ukraine.

Experts are forecasting that all contract rates will decline steadily in the upcoming month, but for how long…?

Will ocean rates continue to drop in H2 2022?

In April this year, Maersk was already expecting rates to cool in the second half of 2022. And they reduced their forecast for global shipping demand down to -1% and +1%, from their previous expectation of 2%-4%.

IHS market is also forecasting reduced container freight rates in H2. They predict rates will decline by 20-30% to an average of about $6,000-7,000 per box (FEU) in the second half of 2022, from an average of about $9,000-10,000 per box (FEU) over the same period last year.

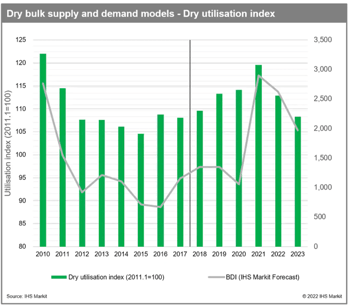

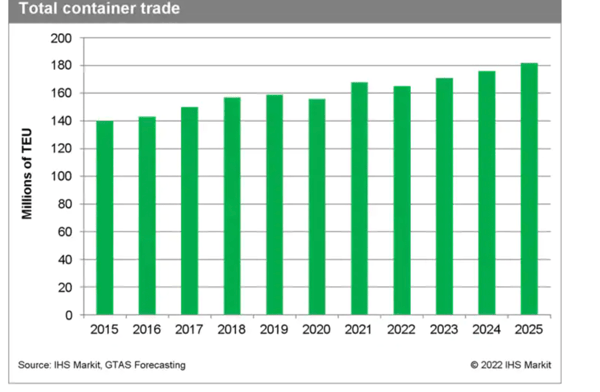

They’re also predicting demand for Dry bulk will continue to fall throughout 2023, but that total container trade will continue to grow after a slight dip in 2022.

Are you ready to take advantage of falling contract rates? An agile freight procurement strategy ensures your procurement team can act in an instant and reap the best rates for your key lanes. Discover everything you need to know about agile freight procurement in this whitepaper.