Benchmarking is what you call the process of comparing and monitoring different freight rates over time. The benchmarking data is depicted in different indices. So why do some companies seem to pay large amounts of money for this market data? What is it that makes the monitored freight data so interesting? And how can it change Logistics Procurement?

Index based buying in logistics procurement

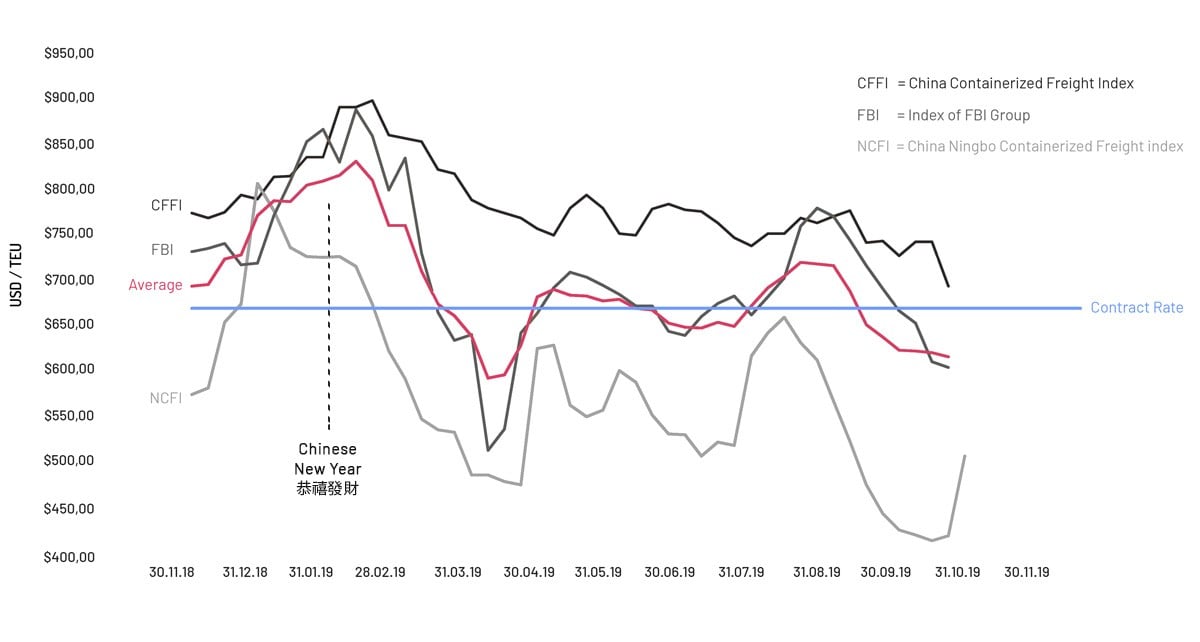

It is of course the heightened bargaining power obtained through more competitive freight rates based on benchmarking data. If we take a look at the data and the different indices, we see how all the indices, are somehow following the same pattern for a given lane over the years, like in our example from 2018/2019. For the lanes Asia-Europe there is a pretty wide range of indices already and for our example Shanghai Port (CNSHA) to Hamburg Port (DEHAM) we can already visually validate the non-randomness of the data in general with the same pattern, that all of the indices follow.

Source: En.sse.net.cn, En.shippingchina.com, Balticexchange.com, Fbx.freightos.com.

Furthermore, we can see specific and visibly recurring features over the years. It is easy to see the price drop in the end of Q1 in our example. This occurs due to the Chinese New Year in which the Chinese production is standing still for about two weeks depending on the moon phase between January 21st and February 21st and therefore leads container shipping into a bottleneck after the festivities. As soon as this bottleneck is overcome, we expect the prices to drop for about the next two months, until the demand stabilizes again, and the freight rates settle in around the average.

Knowing these circular patterns and the lane specific prices in general, you might have an informational advantage in the intransparent market and furthermore you might want to rethink some tactical sourcing strategies in regard to the right time to launch your freight tender. Of course, you can also see which contract rate is appropriate compared to previous years.

The limits of benchmarking in logistics procurement

Before we go further into the analysis of the possibilities regarding the sourcing, it is important to also draw the boundaries of benchmarking’s capability. First of all, benchmarking does not provide the kind of index, to look into the future with. Some indices only provide spot market data, while others provide a three-month horizon due to knowledge about the last three-month of contractual period for existing agreements. Still the recurring patterns over several years do give the data some kind of a predicting power as well.

Second, the indices are not homogeneous in the way they are statistically made. The CCFI for example uses the price data of eight different Freight Forwarders, while the XFI©️ on the other hand is generated from different data provided by a variety of shippers and freight forwarders. In general, it is important to always keep in mind that every agreement of freight rates may have specific terms attached which are hard to compare, for instance specific special demurrage / detention free times, freight volume, verticals and pick up / drop off locations of containers. This of course affects the comparability.

Third, the freight rates are strongly influenced by external shocks on the market. Natural catastrophes, volatility in oil-prices, new trade barriers and market shortages like in the case of Hanjin’s bankruptcy in 2016, are undeniably influencing the prices. Therefore, it is advisable to take data of several years into account and to double check outliers for external price-shocks in the past.

The future of logistics procurement: Procurement Intelligence supported by benchmarking

Regarding the tactical procurement process by launching a freight tender it is advisable to take a look at the average of the indices. So far most global enterprises bundle up their freight tenders to save time and process cost. Benchmarking data might change these existing habits in logistics procurement. What if the benchmarking data suggests a lower price for a certain time period? Procurers might have an incentive to time their tenders in response to their benchmarking data, to save freight and logistics procurement costs. These Index Based Buying strategies that launch RFQ’s based on lows in freight indices are already a trend in logistics procurement. The agglomeration of volume for a higher bargaining power in logistics procurement is more and more replaced by an Index Based Procurement Intelligence using multiple mini tenders that are timed by the knowledge about freight rates over time.

Another informational advantage is given regarding the eventuality of renegotiations with the carriers, if their freight rates are above the ones suggested by benchmarking data. The data could be the key decision criterion for whether to launch a new tender or to go into extension negotiations with the existing suppliers.

The long-term implications of this point are crucial for the understanding of future market situations. If benchmarking data is becoming more advanced and its predicting power lifts the market transparency from today’s darkness into a sufficiently transparent market, the freight rates might not even be determined by the carriers anymore. The market might become more of a transparent polypolistic market in which the carriers are price-takers and have to adjust their terms and conditions to a given market price, determined by a data driven pricing process. But again, that is the future so far. Startups are pushing the digitization and transparency into the market and are working on new, flexible and efficient solutions to tender freight in the future.

With SHIPSTA you can manage freight rates to gain the ultimate visibility, check the competitiveness of your rates and integrate Benchmark Data into the Rate Management to know at any time how your rates compare to the market. We are constantly working on our technology based on standardized verticals, real data and algorithms to help you identify the perfect balance between price, quality and availability.

About SHIPSTA

SHIPSTA powers smart logistics procurement with a digital platform that connects shippers and carriers to ensure a frictionless procurement process for spot and contract buying, entirely online. It automates complex tasks, provides unrivalled visibility and supports fast data-driven decision-making. Designed and built by experts in logistics procurement, it is bringing transparency, automation and efficiency to the global logistics industry. It is used by some of the world’s largest companies to respond to market volatility, control freight costs and manage risk. The company was founded in 2015 and is based in Mertert, Luxembourg and Hamburg, Germany.