The shortage of HGV drivers has become such a big issue it’s no longer a niche logistics topic – it’s dominating the mainstream news. The UK may be the focal point right now (with a reported shortage of 73 thousand drivers), but there are shortages reported across Europe and North America too.

In the US, there is a shortfall of around 63 thousand drivers, which experts predict will surge in the next five years without proper intervention. And the driver shortfall across Europe is a whopping 400 thousand!

So, what is causing this massive driver shortage in the first place?

Why is there a shortage of truck drivers?

The shortage of drivers across Europe and in the UK has been caused by multiple factors. Here are some of the main issues…

Backlogs due to Covid-19 have reduced HGV driver numbers

Before the Covid crisis hit, there was already a well-reported shortage of HGV drivers in major markets. In 2019, 24% of trucker positions were vacant in the UK. And many European countries had similar shortfalls: 22% in Poland, 21% in the Czech Republic and 20% in Spain.

However, the social distancing restrictions imposed during Covid exacerbated this problem as new drivers were unable to train and take their HGV driving tests. In the UK alone, 25,000 fewer drivers passed HGV driving tests in 2020 compared with 2019.

With restrictions easing and economies and growth levels bouncing back, demand for HGV drivers has surged – but the number of new drivers has not been able to keep up.

Brexit exacerbated the UK's HGV driver shortage

Naturally, Brexit has only affected the UK. However, the impact created wide-reaching disruptions that reportedly left supermarket shelves bare and even resulted in McDonald’s running out of milkshakes.

So, why’s Brexit to blame? Well, of course, it’s not the sole cause of the driver shortages, but exiting the free trade union has had an impact. Leaving the union means European workers can no longer live and (most importantly!) work in the UK without a visa – so there’s a much smaller pool of drivers than before.

That’s not to say no Europeans are working in the UK. Those working and living in the UK before December 31, 2020, could apply for residency and retain their right to stay and work. However, you had to be living in the UK before that deadline. Unfortunately, throughout 2020, many EU workers living in the UK returned home due to the pandemic – including 25 thousand drivers. As many of these drivers didn’t return before the December 31 deadline, they were unable to maintain their right to work in the UK without a visa.

To combat this, the UK government offered 5,000 temporary visas to truck drivers from the EU in September this year. However, many are commenting that this will not be enough to fill the shortfall.

In an interview with Reuters, Andrew Opie, director of food and sustainability at the British Retail Consortium, said these plans were insufficient.

"The limit of 5,000 visas will do little to alleviate the current shortfall," he said. "Supermarkets alone have estimated they need at least 15,000 HGV drivers for their businesses to be able to operate at full capacity ahead of Christmas and avoid disruption or availability issues."

It seems time will tell on whether the strategy is successful or not – but many Britons are bracing themselves for a Christmas with less on the shelves.

Fewer people are choosing truck driving as a career

Over the past decade, truck drivers have complained about substandard working conditions, tighter schedules and stagnant salaries across North America and Europe. This has made choosing a driving career less attractive to people who might have otherwise joined the profession.

Many trucking firms are addressing these issues by increasing pay. Drivers in the UK are reporting salary increases of 40% this year, as their employers try to retain current staff and attract new candidates to the job.

These new incentives may well drive (excuse the pun) new talent to the industry, but this won’t be a fast-acting remedy. HGV drivers must first train and then sit a test to get an HGV license. The entire process takes about eight to ten weeks, meaning we can’t expect new recruits to help fill gaps for at least two months.

HGV drivers are retiring

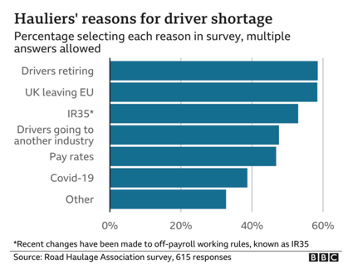

The average age of truck drivers in Europe is 44 years old – in the UK it’s 55! With so many drivers on the road to retirement, it’s becoming a big issue for trucking firms. A survey found that Hauliers listed ‘Drivers retiring’ as the leading cause of the shortages – above Brexit and Covid-19!

The trouble is there’s not much the industry can do to stop people from retiring. All companies can do is focus on replacing them with new, younger staff. So the trucking firms will have to continue stepping up their efforts to improve conditions for workers.

How to keep your road freight moving

Driver shortages look like they’re here to stay for the foreseeable future - so what can you do to minimise the impact and build resilience into your road freight strategy?

Monitor your current road carrier pool

If you’re managing hundreds or even thousands of shipments, it’s difficult to truly know who your best suppliers are off the top of your head. You need to know which carriers you can rely on – especially for important and time-critical shipments.

Centralising all your carrier data onto one platform makes it easy to monitor which carriers are your most reliable. You can build up an invaluable knowledge base that can inform every shipper in your business which suppliers to use for high-priority shipments.

And you can use this information to strategically focus on building iron-clad relationships with your very best suppliers….

Build strong relationships with your top trucking carriers

A strong shipping strategy needs strong supplier relationships backing it up. Once you know who your best suppliers are, you want to nurture a strong relationship with them. To ensure they prioritise your business, you need to prioritise them in return. Simple things can make a big difference, such as:

- Always paying on time

- Responding promptly to communication

- Communicating they are your preferred supplier.

Basic things like this will foster a strong, reliable relationship and ensure they prioritise your business when you hit a supply chain snag. Using a centralised tool makes maintaining these relationships simple as all your carrier information is stored centrally, so you can access everything in one place.

Plus, the software saves you hours in admin by taking over time-consuming and monotonous tasks – so you have more time to plan strategically and build on your carrier relationships. How much time does it save you? With SHIPSTA you can create an RFQ in just six minutes – instead of hours – learn how here.

Expand your road freight carrier pool

Finding new suppliers that fit your needs isn’t always straightforward. Unlike sea freight, where there are a few dozen large suppliers, there are thousands of road suppliers to wade through.

You’d think having more options is better, but it can make it difficult to find a reliable supplier that fits your business's specific needs.

However, with the help of a centralised database, like SHIPSTA, it’s easy to find new suppliers that match your business needs. In SHIPSTA’s supplier portal, you can access thousands of new road freight suppliers and easily find the best carrier for your needs. You can even open up RFQs to new carriers, so they can directly quote for your business - without you having to spend time searching for the right find.

Want to learn more about how SHIPSTA can help you navigate the trucking crisis, book a demo with one expert consultant today.

About SHIPSTA

SHIPSTA powers smart logistics procurement with a digital platform that connects shippers and carriers to ensure a frictionless procurement process for spot and contract buying, entirely online. It automates complex tasks, provides unrivalled visibility and supports fast data-driven decision making.

Designed and built by experts in logistics procurement, SHIPSTA is bringing transparency, automation and efficiency to the global logistics industry. It is used by some of the world’s largest companies to respond to market volatility, control freight costs and manage risk. The company was founded in 2015 and is based in Mertert, Luxembourg and Hamburg, Germany.