Freight forwarders spend around $20 billion on repositioning empty containers every year!

With a bill higher than the GDP of some countries, it’s a massive problem for the logistics industry. So, what exactly is empty container repositioning and why is it happening?

What is empty container repositioning?

In an ideal world, every shipping container would be full every journey, but in reality, this isn’t possible.

Often, a carrier will have a surplus of empty containers at one port (London, for example) but won’t have enough containers for a shipment from another port (Shanghai, for example). This means the carrier has to reposition the empty containers to the Shanghai port without any cargo inside - which is why it's called 'empty container repositioning'.

An empty container takes up the same space on a ship as a full one, so the cost of moving it is also the same. And with no one paying to fill that container with goods, the cost comes directly out of a carrier’s pocket and eats into their profits.

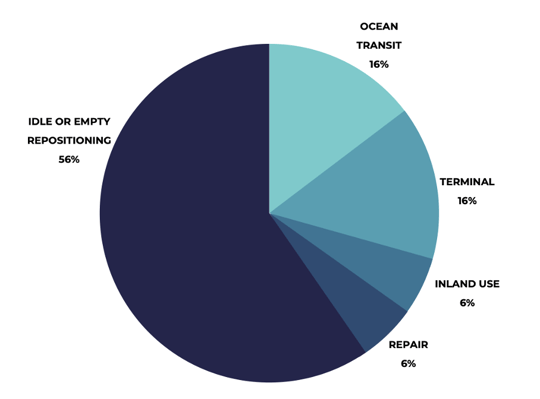

If carriers only had to ship a small number of containers empty, these costs would easily balance out. But the average container spends a whopping 56% of its lifespan either idle or empty – which is more time than they spend shipping cargo and generating revenue.

(Data credit: transmetrics)

(Data credit: transmetrics)

So, why is the logistics industry wasting so much potential space when margins are so tight?

What causes empty container repositioning?

There's a combination of factors that contribute to empty container repositioning. Here are the main causes:

1. Trade imbalances

A port that imports more than it exports will end up accumulating empty containers simply because there’s nothing to put in them. Similarly, if a port exports more than it imports, it will eventually run out of containers to ship all of its cargo.

To deal with this imbalance and avoid port bottlenecks, companies have to ship empty containers from ports with a surplus to ports with a deficit, tying up capacity and increasing transport costs.

The most common container imbalance is between the West and Asia. European and American ports tend to have a surplus of empty containers while Asian ports often face shortages.

2. Storage costs

Carriers would be more inclined to wait at ports for new cargo if they could store them for free. But storing an empty container at a port can cost hundreds of dollars depending on how long they’re there.

Carriers can usually store a container at a port for around five days for free, but if they go over this limit it can cost $100 per day! The exact cost of container storage will depend on the contract between the shipping company and the port – but it usually adds up fast. This means it’s often more cost-effective for carriers to move empty containers than to wait and ship them full.

3. Time pressure

If export demand is very high in one region, carriers have to ensure they have enough containers at these ports. To keep up with demand, carriers have to prioritise sending empty containers to these ports as fast as possible.

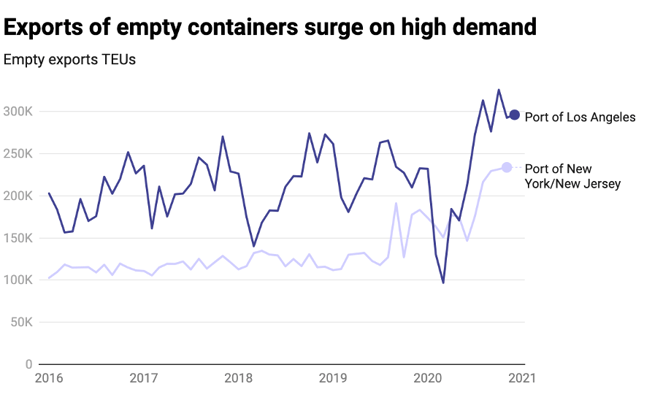

A good example of this happened in 2020 and 2021 during the coronavirus pandemic. Consumers in America and Europe shifted their spending from services, like eating out, to tangible goods they could enjoy in their own homes. This caused imports to soar, pressuring carriers to move more empty containers to exporting ports quickly.

This resulted in some carriers shipping 75% of their containers from the US and Europe to Asia empty.

(image credit: Suppychaindrive)

4. Outdated logistics planning

The logistics industry is notoriously old-school and still relies on outdated technology. This reluctance to innovate means many shipping companies still use Excel to plan their container repositioning.

Using complex excel sheets makes it difficult to plan efficiently and leads to logistics companies shipping more containers empty than they need to.

There is logistics tech on the market that utilises AI to help shipping lines plan empty container reposition in the most efficient way – but many companies are still hesitant to make the switch.

5. Lack of cooperation between carriers

Imagine a scenario where a carrier (let’s call them Carrier A) has to ship cargo from Sweden to the US but doesn’t have enough containers. Meanwhile, their competitor (Carrier B) has too many containers in Sweden and is repositioning them empty to the US.

If Carrier B let Carrier A use their containers, both companies would save money and it would be more efficient and environmentally friendly in general.

With carriers and leasing companies moving millions of containers around the world every day, this scenario happens all the time. But with so much competition between these companies, many refuse to share information on their container positions and volumes with each other. This makes it difficult to set up container pools to avoid empty container repositioning.

How can shippers benefit in the current market? Download our eBook to uncover the 5 key opportunities that shippers can leverage in 2023 (and how to benefit from them).

About SHIPSTA

SHIPSTA is a digital platform that connects shippers and carriers to ensure a frictionless procurement process for spot and contract buying, entirely online. It automates complex tasks, provides unrivalled visibility and supports fast data-driven decision making.

Designed and built by experts in logistics procurement, SHIPSTA is bringing transparency, automation and efficiency to the global logistics industry. It is used by some of the world’s largest companies to respond to market volatility, control freight costs and manage risk. The company was founded in 2015 and is based in Mertert, Luxembourg and Hamburg, Germany.

.png?width=865&height=273&name=Ocean%20Campaign%20Email%20Footer%20(1584%20%C3%97%20500px).png)