The logistics industry is packed with technical jargon and acronyms. The term 'BAF' is one of the more complex terms. You man already understand it as a term for additional charges carriers add onto contract rates. But why do they add on these charges and what are the different types of BAF?

What is BAF in ocean freight?

BAF stands for 'Bunker Adjustment Factor'. It's also known as BUC (Bunker Contribution) or SBF (Standard Bunker Adjustment Factor). Everyone uses their preferred term to refer to the same thing, so don’t get confused there.

The only word that appears in all the terms is ‘bunker’ which is the name of the ship’s fuel.

The ship operators have to pay for the fuel to the respective local supplier and afterwards try to pass the cost on to the customer through the BAF. The BAF might be charged separately or might be a part of the freight rate, depending on the agreement and line.

BAF refers to the topic of volatility in oil prices that both carriers and shippers want to hedge. They need price security for the bunker to calculate their respective prices for transport or products.

What kinds of BAF exist in ocean freight?

There are three different ways shippers distribute the cost of fuel: ‘fixed BAF’, ‘floating BAF’ and ‘locked-in BAF’. Let's dive into the difference between these different types of BAF.

1. Fixed BAF

A fixed BAF is a fee that has to be paid for the bunker, no matter how the oil prices develop. Once the shipper and carrier agree on a price for fixed BAF it won't be changed - even if oil prices change. This is a popular BAF option as procurement managers can accurately predict exact costs.

2. Floating BAF

Unlike fixed BAF, floating BAF is linked to the development of oil prices. This option gives decent price security to the carrier as they won't lose any money no matter how oil prices evolve. This BAF option does decrease the price security for shippers as they don’t have any guarantees on the final cost of their transport.

3. Locked-In BAF

The third option is the locked-in BAF, where both parties agree on a locked-in bunker price for a certain period of time. It is kind of a compromise between the previous two BAF models, disadvantaging and advantaging different parties depending on the direction of the price development. Shippers would gain a surplus if the fuel price decreases during the contract period of the locked-in BAF, where as carriers would end up out of pocket.

How is BAF calculated in ocean freight?

Ship operators and shipping lines update their BAFs in ocean freight on a regular basis, often monthly, but also annually or semi-annually, depending on what their customers are looking for and how oil prices develop. To avoid criticism regarding the transparency of BAFs, shipping lines developed pricing models for the BAF based on neutral data provided by third-party agents.

Here are examples of the different pricing models leading carriers use:

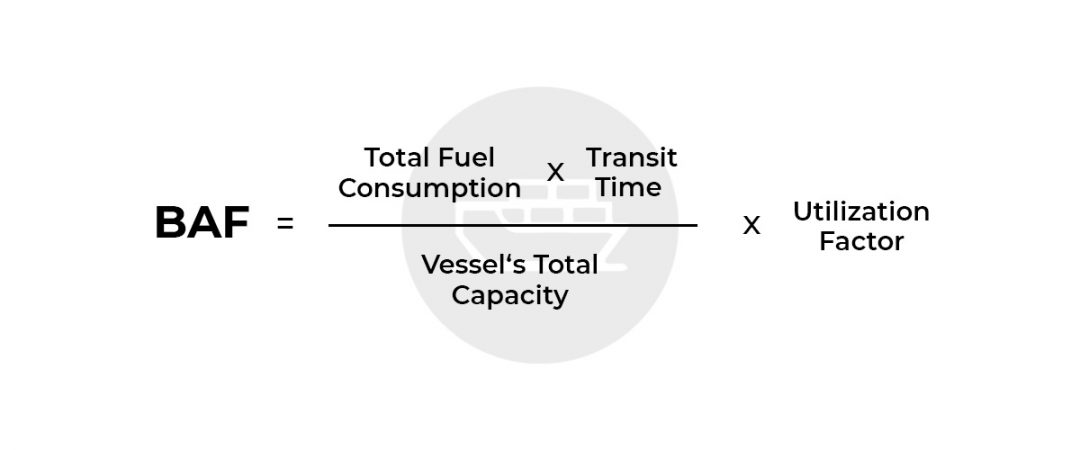

Maersk's BAF formula

This is the formula Maersk uses to make their BAF traceable:

BAF = (Total Fuel Consumption x Transit Time ) / (Vessel’s Total Capacity) x Utilization Factor

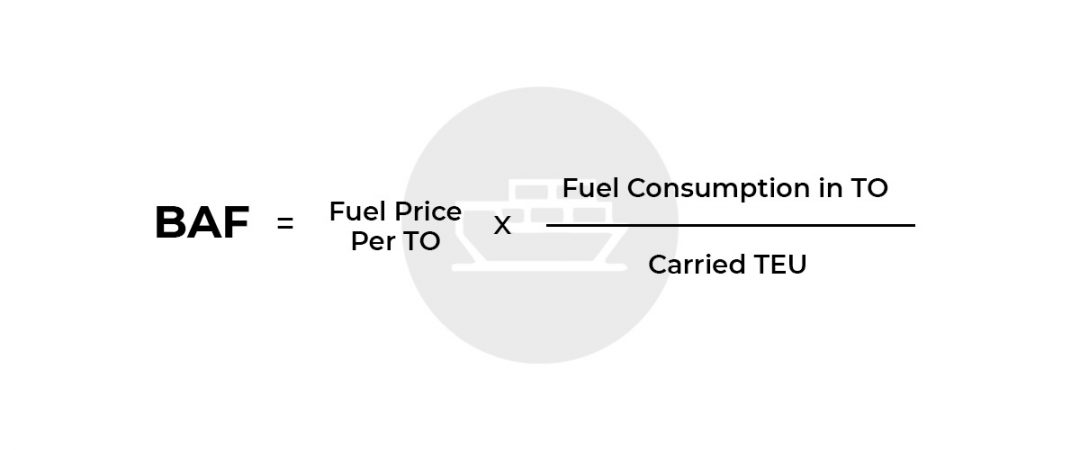

Hapag-Lloyd's BAF formula

BAF = (Fuel Price Per TO) x (Fuel Consumption in TO) / Carried TEU

Both formulas are types of floating BAF, meaning shippers have price security for their transportations, depending on oil prices. And both companies calculate their new BAF quarter-annually. However, Hapag-Lloyd increases this to monthly if oil prices exceed $45 per ton. This is meant to provide a flexible and transparent solution, without creating unmanageable chaos if too many rates need updating. However, quarterly rates can become an administrative challenge, and with every shipper having their own formula, it is getting harder and harder to manage the BAF in procurement.

Why is BAF included in ocean freight rates?

Why is BAF even an extra fee? Of course, shippers could also offer an all-inclusive price for the transport. A fixed bunker price or even a CY/CY (Container Yard to Container Yard) agreement would be a way to reduce lots of effort for decision making and could as well provide price security for both parties. With vessels becoming more efficient, bunker prices are becoming a less dominant cost factor. This means we're likely to see fixed bunker prices become an increasingly popular market.

Want to know how you can improve planning and risk control by managing fuel volatility? Read our industry eBook to uncover the key opportunities shippers can leverage in 2023.

About SHIPSTA

SHIPSTA powers smart logistics procurement with a digital platform that connects shippers and carriers to ensure a frictionless procurement process for spot and contract buying, entirely online. It automates complex tasks, provides unrivalled visibility and supports fast data-driven decision-making. Designed and built by experts in logistics procurement, it is bringing transparency, automation and efficiency to the global logistics industry. It is used by some of the world’s largest companies to respond to market volatility, control freight costs and manage risk. The company was founded in 2015 and is based in Mertert, Luxembourg and Hamburg, Germany.

.png?width=814&height=257&name=Ocean%20Campaign%20Email%20Footer%20(1584%20%C3%97%20500px).png)