International container shipping is a seismograph of the global economy. That makes it all the more vital to take the right measures to stabilise the freight market as much as possible even in turbulent times and make it a reliable partner for shipping agents. Global container traffic alliances have shown that they can achieve this goal.

Container shipping reacts more sensitively to global economic crises than almost any other sector

The most recent and perhaps most drastic example is Hanjin’s bankruptcy in 2017, when the South Korean shipping company finally succumbed to debts of more than 5 billion US dollars. “Hanjin’s bankruptcy once again heightened the awareness among shipping companies that they needed to operate more cost-effectively and use the space on their ships more efficiently,” says freight expert Jesper Johansen, who was with Dachser for two decades and is now Business Development Manager at a Danish logistics IT specialist.

Overcapacity and bottlenecks have a direct influence on shipping’s purchasing strategy. Overcapacity often occurs a few weeks after the Chinese New Year (between late January and late February) as well as late August. These are periods in which prices tend to fall because supply exceeds demand. The major trade routes from Asia to Europe have their high season from mid-December to March, when many companies begin to import goods such as garden furniture which will sell in spring and summer. The other peak demand period for containers is from the end of June to the end of August, when many Christmas goods are imported. Jesper Johansen: “Shipowners take advantage of this high season to increase their shipping rates as they know that rates will fall in the periods to follow due to the drop in demand.”

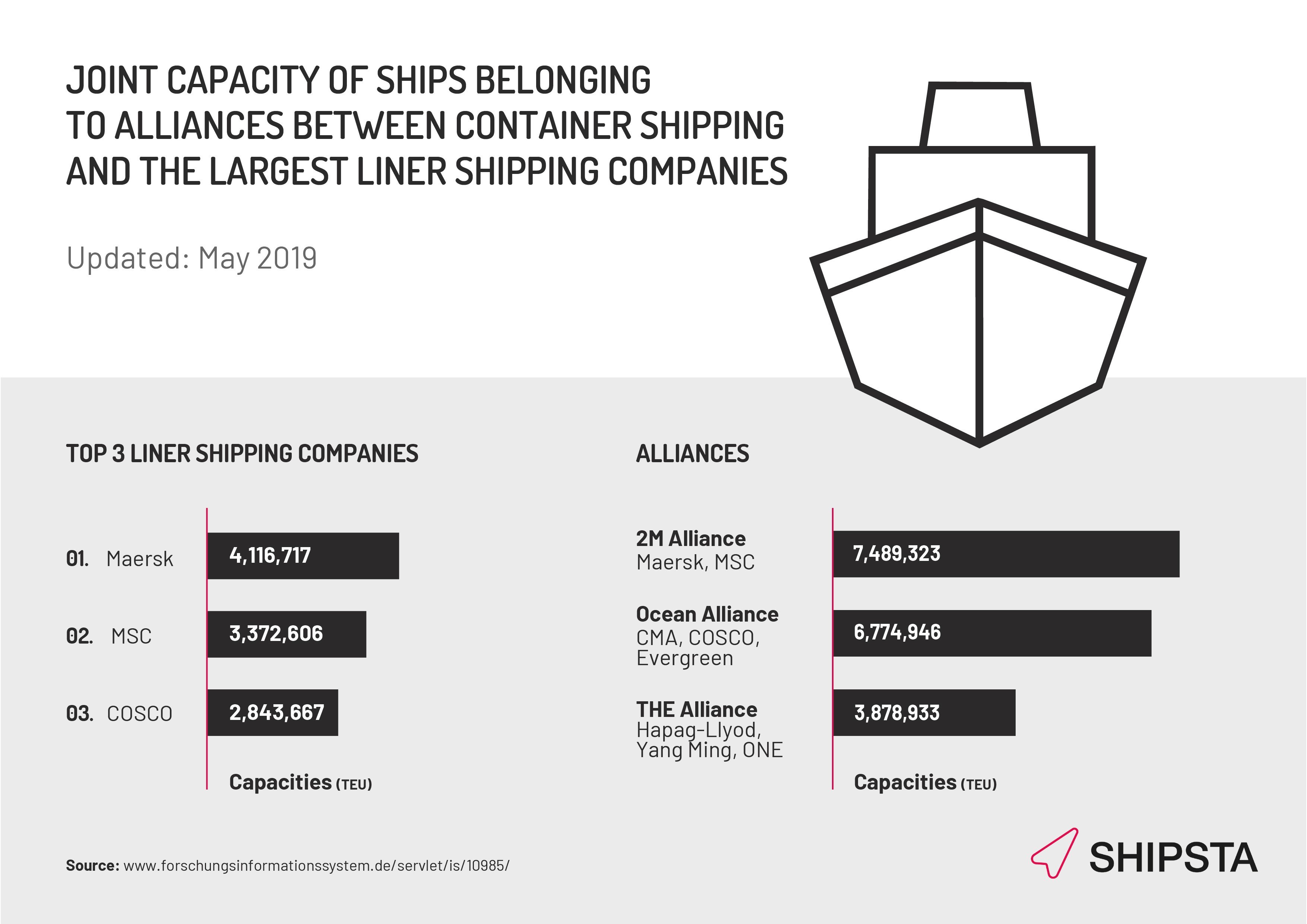

The three major alliances

Shipping conventions were founded as early as the middle of the 19th century in order to regulate the market. They were abolished for antitrust reasons in 2008 and replaced by global alliances. The dominant shipping lines merged into just three entities operating globally: MAERSK and MSC form the 2M Alliance, CMA, COSCO and Evergreen join forces in the Ocean Alliance, while THE Alliance is made up of Hapag-Lloyd, Yang Ming and ONE, all working together (see chart). “Today, these three major shipping alliances control about 75% of the global container market,” says expert Johansen, “and appear to have been much more effective in cushioning exchange rate fluctuations in 2019 than in previous years, where rates have sometimes quickly risen by 50%, only to then fall again.”

The more stable tariff level means that it is now much easier for shippers to create sustainable budgets for their shipping costs – while at the same time being able to focus more on other costs such as port dues and liability provisions at their destination. When looked at in isolation, these factors can make a big difference to margins.

So, the main objectives of the alliances are to make better use of economies of scale and improved ship utilisation. They also facilitate entry into new markets, as the shipping companies have the opportunity to use the other partners’ slots rather than having to invest extra ship capacity of their own. These alliances are also an attractive model for shippers, as they facilitate transportation of goods with their “one-stop-shop” principle. The global alliances serve to significantly increase geographical reach and also to expand a global network of liner services.

The struggle for a stable and reliable market is a daily challenge, all the same, even in these times of global alliances. “Shipping companies still struggle with overcapacity – and the trade war between China and the USA has done nothing to improve the situation either,” says Jesper Johansen. “Many shipping companies have had to order ships up to the Panamax class to secure their future and not end up losing market share to competitors. However, several studies caution that more ships than are needed are still being ordered!”

This is certainly going to be a hot topic for discussion at Container Trade Europe! The industry is getting together at the conference in Hamburg from 16 to 18 September. SHIPSTA is this years‘ sponsor and we would like to show our eProcurement platform that allows the simple, efficient and flexible procurement of freight rates and intelligent rate management. Our vision: Creating the first Virtual Procurement Manager who autonomously runs procurement activities, based on machine learning.We would like to catch up with you at our booth at the conference venue. Looking forward to meeting you in Hamburg!

About SHIPSTA

SHIPSTA powers smart logistics procurement with a digital platform that connects shippers and carriers to ensure a frictionless procurement process for spot and contract buying, entirely online. It automates complex tasks, provides unrivalled visibility and supports fast data-driven decision-making. Designed and built by experts in logistics procurement, it is bringing transparency, automation and efficiency to the global logistics industry. It is used by some of the world’s largest companies to respond to market volatility, control freight costs and manage risk. The company was founded in 2015 and is based in Mertert, Luxembourg and Hamburg, Germany.